OPINION

From Debt Relief To Debt Trap: Nigeria’s Worrying Return To Borrowing

BY ISAAC ASABOR *

At a point in Nigeria’s political history, the country was on the verge of an economic renaissance after successfully negotiating its way out of the crushing burden of external debt. Under the skilled leadership of Dr. Ngozi Okonjo-Iweala, Minister of Finance and Economy, Nigeria accomplished what many thought was impossible: significant debt forgiveness from its creditors. This milestone relieved Nigeria of a significant burden, leaving the country virtually debt-free. It was a time of hope and optimism, as the country was poised for economic growth free of the constraints of external debt.

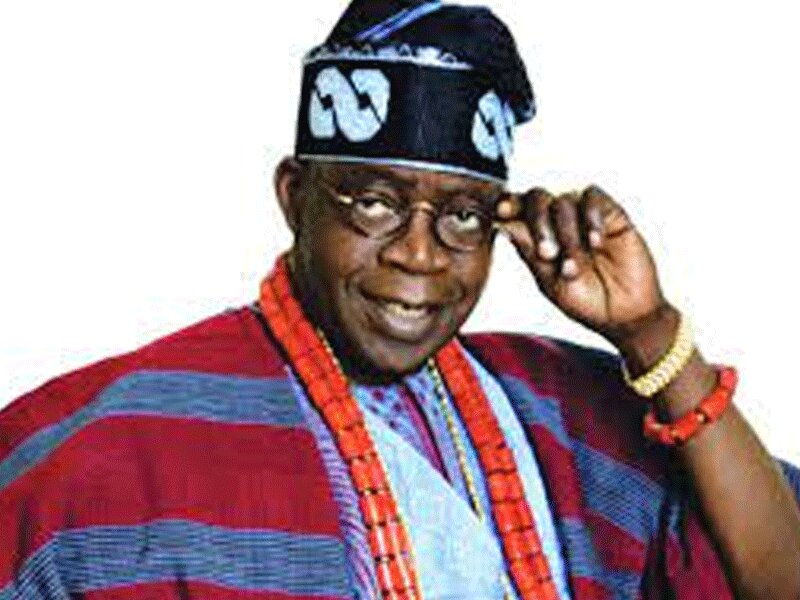

Fast forward to the present day, and Nigeria finds itself in a precarious situation. Former President Muhammadu Buhari and current President Bola Tinubu have led the country back into an alarming debt spiral. The debt situation has grown to the point where it threatens the nation’s financial future. With billions borrowed from international institutions such as the World Bank and China, the country is now saddled with debt service payments that consume a significant portion of its revenue.

The Debt Management Office (DMO) reported that Nigeria’s debt increased by ₦24.33 trillion in three months, reaching ₦121.67 trillion as of June 2024. The DMO noted that the increase was due to new borrowing to help finance the 2024 budget deficit.

According to the DMO, Nigeria’s total public debt was ₦121.67 trillion in June 2024, with domestic and external debts totalling ₦121.67 trillion as of March 31, 2024.

The DMO reported that Nigeria’s debt increased by ₦24.33 trillion in three months, from ₦97.34 trillion in December 2023 to ₦121.67 trillion. This debt includes borrowings by the Federal Government, 36 state governments, and the Federal Capital Territory.

This disturbing return to indebtedness raises a slew of issues. How did we go from debt-free to heavily indebted again? What happened to the prudent fiscal management that once kept us from perpetual borrowing? These are questions Nigerians must ask, as the consequences of our current debt situation have a significant impact on the country’s economy and future generations.

More troubling is that, despite the growing debt, Nigerians are not seeing tangible benefits such as improved infrastructure, social services, or job creation. Instead, we see a government bloated with excessive spending, with the cost of governance remaining exorbitantly high. Lavish spending on government officials, role duplication, and an ever-increasing number of political appointees are just a few examples of the system’s ongoing financial leakages.

It is deeply concerning that as the country borrows more, the cost of governance goes unchecked. The Nigerian government must face a harsh reality: its current borrowing strategy is unsustainable. The government urgently needs to reduce the cost of governance. This includes lowering public officials’ salaries and allowances, limiting the number of political appointees, and eliminating wasteful spending at all levels of government.

A leaner, more efficient government structure is not only desirable but also required if Nigeria is to manage its debt and put borrowed funds to good use. Public investment should be prioritised in sectors that can stimulate economic growth, such as infrastructure, agriculture, and education, rather than being consumed by recurring expenses with little to no long-term impact.

Nigeria’s return to a debt-laden economy is a cause for concern. We must remember the days of fiscal prudence that resulted in debt relief and work to restore those principles. The government must act quickly to reduce unnecessary costs and ensure that borrowed funds are used transparently and efficiently for the benefit of all citizens, not just the political elite.

The stakes are too high for us to continue on this path. We owe it to future generations to break the cycle of borrowing and create an economy that can function without the crutch of external debt. The time to act is now before the debt trap tightens its grip on Nigeria’s future.

Given the foregoing, it is prudent to urge President Bola Tinubu to prioritise efforts to free Nigeria from the crippling weight of both domestic and external debts. The country is at a financial crossroads, and its growing debt burden is becoming unsustainable.

Without decisive action, Nigeria risks falling deeper into a debt crisis, jeopardising economic development and social progress. The administration must implement a strong debt management strategy aimed at reducing excessive borrowing, increasing revenue generation, and improving fiscal discipline. The preceding viewpoint is that the future of Nigeria’s economy is dependent on the actions taken now to avoid further debt accumulation.

President Tinubu should consider negotiating for debt forgiveness, as Dr. Ngozi Okonjo-Iweala did while she was Minister of Finance and Economy. At the time, Okonjo-Iweala successfully negotiated with Nigeria’s creditors to obtain significant debt relief, allowing the country to regain financial stability and focus on long-term growth. Tinubu could alleviate the crushing debt service burden, which currently consumes a large portion of the country’s revenue, by pursuing similar negotiations. International creditors may be willing to renegotiate terms if Nigeria presents a credible and transparent economic reform plan that demonstrates its commitment to fiscal responsibility.

In addition to seeking debt forgiveness, President Tinubu must take bold steps to reduce the cost of governance and increase the efficiency of government spending. Every naira saved by cutting unnecessary expenses and plugging financial leaks can be used to pay off Nigeria’s debts and invest in sectors that promote economic growth. President Tinubu can pave the way for Nigeria’s economic future by combining debt forgiveness negotiations and internal fiscal reforms. The time to act is now before the country’s debt load spirals out of control.

-

CRIME4 years ago

PSC Dismisses DCP Abba Kyari, To Be Prosecuted Over Alleged $1.1m Fraud

-

FEATURED4 years ago

2022 Will Brighten Possibility Of Osinbajo Presidency, Says TPP

-

FEATURED2 years ago

Buhari’s Ministers, CEOs Should Be Held Accountable Along With Emefiele, Says Timi Frank

-

BUSINESS & ECONOMY2 years ago

Oyedemi Reigns As 2023’s Real Estate Humanitarian Of The Year

-

SPORTS2 years ago

BREAKING: Jürgen Klopp Quits Liverpool As Manager At End Of Season

-

SPORTS2 years ago

Could Liverpool Afford Kylian Mbappe For €200 million? Wages, Transfer Fee

-

ENTERTAINMENT2 years ago

Veteran Nigerian Musician, Basil Akalonu Dies At 72

-

FEATURED2 years ago

Tribunal Judgement: Peter Obi Warns Of Vanishing Electoral Jurisprudence, Heads To Supreme Court

-

BUSINESS & ECONOMY2 years ago

Oyedemi Bags ‘Next Bulls Award’ As BusinessDay Celebrates Top 25 CEOs/ Business Leaders

-

FEATURED4 years ago

2023 Presidency: South East PDP Aspirants Unite, Demand Party Ticket For Zone